BUSINESS DISPUTES AMONG PARTNERS

A BUSINESS BREAK UP IS LIKE A DIVORCE

YOU NEED A STRONG ADVOCATE IN YOUR CORNER

A GOOD LAWYER MAKES ALL THE DIFFERENCE

WHEN YOU DON'T KNOW WHERE TO TURN- CALL US Our commercial litigation attorneys have decades of experience in fighting for business owners who were taken advantage of by the partners whom they trusted.

Partner or Shareholder Litigation

WHAT DO YOU DO

WHEN YOUR PARTNER TRIES TO CHEAT YOU?

Our New York business litigation attorneys have decades of experience in handling cases involving partner disputes in a business. We know that a business dispute among partners and fellow shareholders, is like a divorce. There are always hard feelings and the partner or shareholder who is in control of the business feels that they can keep the business without compensating their partner. So if you are the minority shareholder, or are being frozen out of a business, you have the right to an accounting and to a fair distribution. While most majority shareholders believe they can run the business however they want and treat the business like its their personal piggy bank, the minority shareholders or partners in close corporations, partnerships and limited liability companies have rights to have their interest accounted for.

Our New York business dispute attorneys, are among the few attorneys, who will represent a minority interest business owner on contingency. We know that those in charge of a business, have money to pay lawyers to fight and drag things out. Our commercial litigation attorneys also know that the partner who is ejected or frozen out doesn't always have the funds to pay legal fees in a long protracted legal battle. Our commercial litigation attorneys are committed to making sure the little guy, gets a fair shake, and that is why in appropriate cases, we handle commercial cases on contingency, so that our client's ability to pay is not a barrier to them obtaining the justice that they are entitled to.

One of the most common questions that our New York commercial litigation attorneys hear is "My partner cheated me or stole from the business, What are my rights?". The answer depends on a number of factors, including the type of business entity that your company was formed in and whether you have an operating agreement.

THE OPERATING OR PARTNERSHIP AGREEMENT

The first place to look to determine what you are entitled to is the operating agreement. This document may have different names depending on the form of your business, but essentially its function is the same. In a corporation, it is usually called a shareholder agreement, and in a limited liability company (LLC), it is called a member's agreement. A company's operating agreement will usually lay out what a partner is entitled to if they withdraw from the business or are ejected from the business, or if the business is dissolved. This is the first place to look for what you are entitled to is the operating agreement. The operating agreement will also specify events, which trigger a dissolution of the business.

WHAT IF THERE WAS NO OPERATING AGREEMENT

If you were involved in a business that did not have an operating agreement, also known as a handshake agreement, do not worry, you are not out of luck. The law provides a certain framework for default rules which apply unless otherwise agreed, i.e., unless the partners or shareholders have an operating agreement. For partnerships, these default rules are found in the Partnership Law. For corporate entities, these rules are found in the Business Corporation Law. For limited liability companies, these default rules are found in the limited liability corporation law.

FIDUCIARY DUTIES

Regardless of the type of entity, New York law recognizes that partners, shareholders and members of small businesses have fiduciary duties towards each other. A fiduciary duty is a position of trust, whereby the majority shareholder or the management of a business entity has to act for the benefit of the company and its owners, not for themselves. New York law firmly recognizes that those in control of a business must deal fairly with the interests of the investors and partners, including minority ownership, and these rules apply regardless of whether the business is a corporation, limited liability company or partnership. The directors and officers of a corporation or other business entity owe the owners of a corporation or other business entity a fiduciary duty and must perform their duties with conscientious fairness, morality, and honesty in purpose, and they are held, in official action, to the extreme measure of candor, unselfishness, loyalty and good faith. In other words, those who are in control of a company must run the company for the benefit of all of its owners and they cannot act for their own personal benefit or advantage, which does not benefit their fellow shareholders.

If a managing member of an LLC, or a majority shareholder in a corporation or a majority partner, breaches their fiduciary duties, they can be sued. Common examples of breaches of fiduciary duty, include self-dealing, misappropriation of business assets, starting a competing business, taking a corporate opportunity for themselves and freezing out their partners or fellow shareholders from the management of the business.

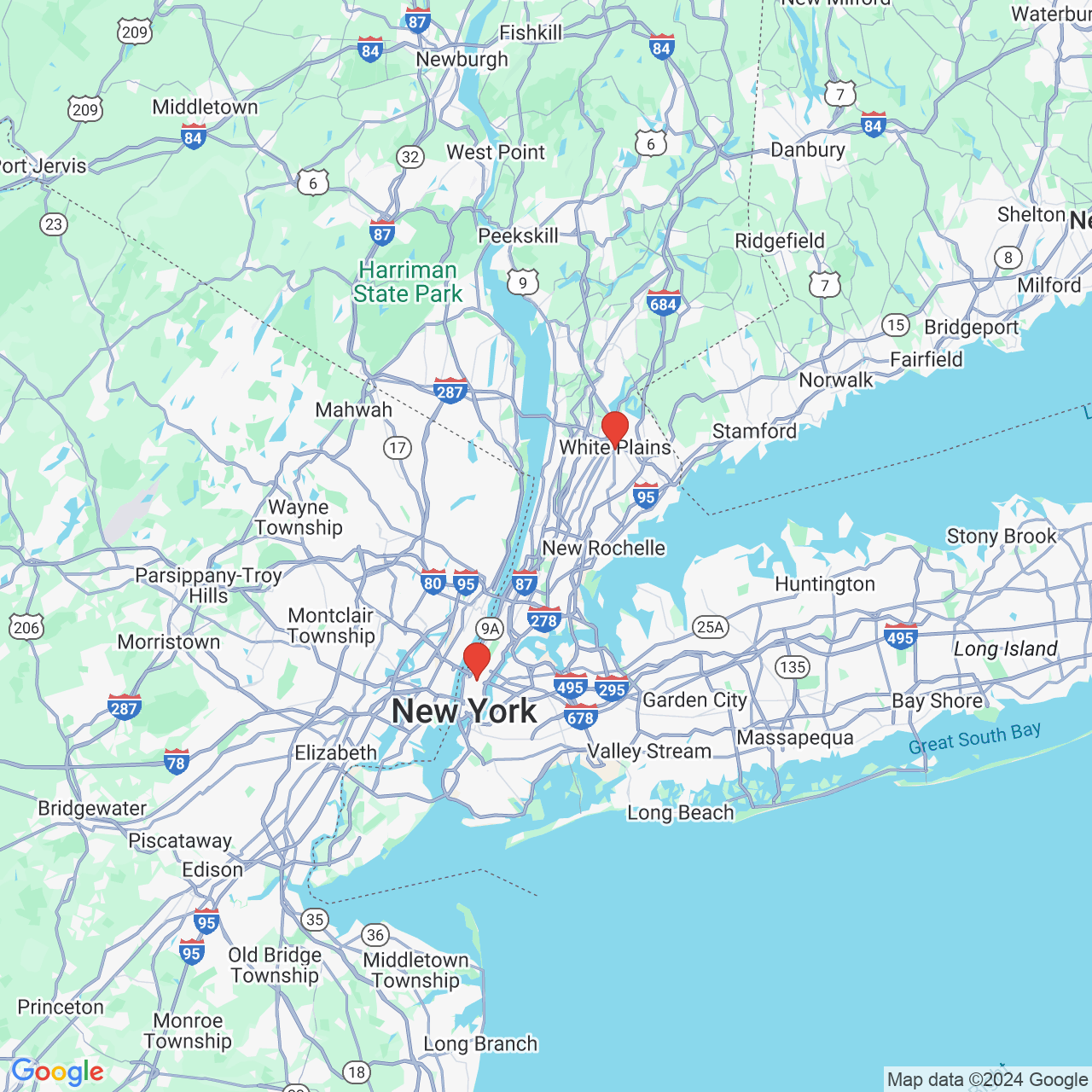

OFFICES IN MIDTOWN MANHATTAN AND WHITE PLAINS

CONSULTATIONS ARE ALWAYS FREE

CONSULTATIONS ARE ALWAYS FREE